-

Applicability:

Customer service is extremely important for sustained business growth and as an organisation we strive to ensure that our customers receive exemplary service across different touch points.

This Policy (Grievance Redressal Mechanism Policy) is applicable to all Customers, Employees and other stakeholders of United Petro Finance Limited (“the Company”).

The purpose of policy is to ensure that;

- All customers are treated fairly and without discrimination at all times.

- All issues raised by customers/employees are dealt with courtesy and resolved on time.

- Customers are made completely aware of their rights so that they can opt for alternative remedies if they are not fully satisfied with our response or resolution to their complaint or grievance.

The Policy has been made as per the Directions / Circulars / Notification issued by Reserve Bank of India (RBI) from time to time.

-

Mode of raising complaint:

- Walk in branch/Call at branch/Email: All branches are maintaining Customer Complaint/Suggestion Register (format enclosed to this policy) for cases as mention in Point 3 of this policy.

- Suggestion/Complaint Box: Suggestion/Complaint boxes are put up at all branches & HO. Customer may drop their suggestions and/or complaints in these boxes. These boxes are opened on periodic intervals by the Branch head or at HO by customer relation officer and forwarded to the respective department for action/resolution.

- Walk in HO/Call at HO/Email: Any kinds of complaints/suggestion for cases as mention in Point 3 of this policy.

All the complaints received by the Company must be recorded and tracked for end-to-end resolution as per the format enclosed to this policy. Complaint MIS is review by Management on quarterly basis.

The department heads are responsible jointly and severally for resolution provided by their teams and for closure of customer issues.

-

The turn-around time for responding to a complaint is as follows:

- Normal cases (other than the one mentioned below): 7 working days for normal cases.

- Fraud cases, Legal cases and cases which need retrieval of documents and exceptionally old records: 17 working days.

- EMI related cases: 21 working days.

- Cases involving 3rd party (other Banks or financial institutions or dealership or if customer out of country): 30 to 45 working days.

Note: Branch Head will deal with only Normal cases as mention above.

(If any case needs additional time, the Company will inform the customer requirement of additional time with expected time lines for resolution of the issue.)

-

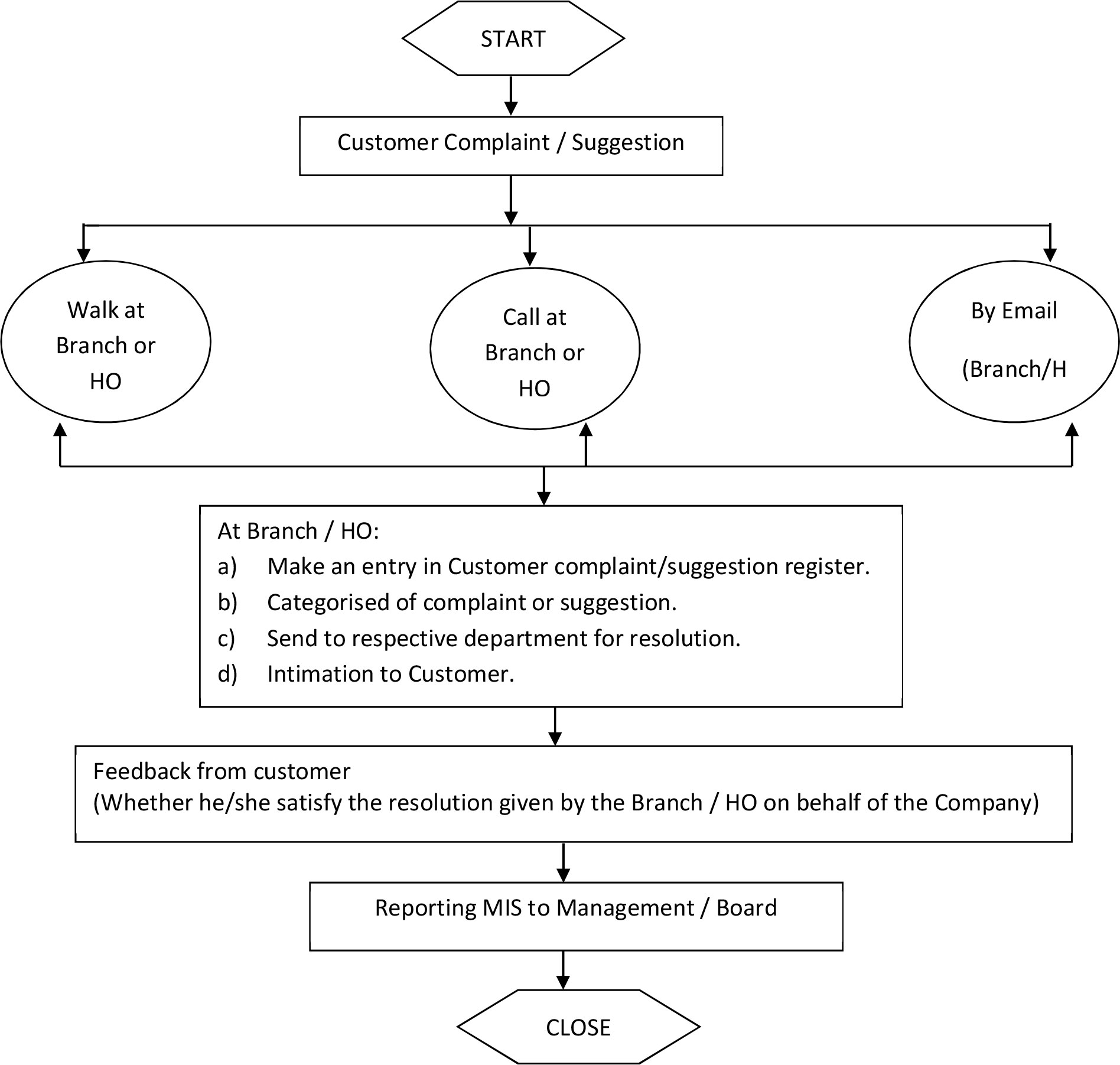

Flow of complaint redressal:

-

Mechanism to handle customer complaints/suggestion:

Customers who wish to provide feedback or send in their complaint/grievance may use the following channels:

Level 1: - The borrowers can directly approach the Branch Manager and enter his/her complaint/grievance in the compliant register maintained at the branch.

- The concerned Branch Official shall guide the borrowers who wish to lodge a complaint. The borrower may also lodge complaints / grievances at the following email id : customergrievance@itiorg.com

- Helpline No: +91-022-40273600 between Monday to Friday from 11 A.M TO 6 P.M. ( except on public holidays)

Level 2: - The customer can also approach Grievance Redressal Officer at the following address :-

Mr Nijeesh Ravindran

Tel. No.:+91-022–69093694 - Email Id: customergrievance@itiorg.com

Add : ITI House 36, Dr. R. K. Shirodkar Marg, Parel,

Mumbai – 400012, Maharashtra

The Grievance Redressal Officer shall endeavour to provide the customer / applicant with the resolution / response to the queries / complaints / grievances received as earliest as possible. After examining the matter, it would be Company’s endeavour to provide the Borrower with our response, within a period of 30 days from the receipt of such complaint/grievance.

Level 3: - If a customer is not satisfied with the resolution provided through various channels or if the complaint/dispute is not redressed within a period, the customer may appeal to Officer-in-Charge of the Regional Office of Department of Non-Banking Supervision of RBI under whose jurisdiction the Registered Office of the Company falls. The details of DNBS are as given below:

The Reserve Bank of India,

Department of Non-Banking Supervision,

Mumbai Regional Office, 3rd Floor,

Opp. Mumbai Central Railway Station,

Byculla, Mumbai - 400008

Phone : +91 - 022 - 23084121

Fax : +91 - 022 - 23099122

Email id: dnbsmro@rbi.org.in